We hope you have all been enjoying your summer so far, as different from normal as it has been. For the

summer issue of our newsletter, we thought it would be beneficial to answer some of the most common

questions we have been asked regarding the RDSP, the funding of the Henson Trust, and ODSP.

In addition, we wanted to let you know that we will be hosting online webinars to educate you further

about disability planning and the Bright Futures Plan. Our next webinar will be held on Wednesday,

August 19th at 7pm. Please click the link here to register for the webinar or visit our website

www.brightfuturesplan.ca to learn more.

If you would like us to host a presentation for your organization to discuss topics specific to your group,

please click on the link here to schedule a webinar.

We look forward to continuing to help you plan towards a Bright Future!

FAQs—Registered Disability Savings Plan (RDSP)

Q. What is a Registered Disability Savings Plan (RDSP)?

A. An RDSP is a registered savings plan established by the Federal Government to assist families in saving for the long-term financial security of individuals with severe disabilities. Government matching and extra funding for low-income beneficiaries form part of the Plan. Contributions to the plan are not tax deductible, but the earnings grow tax free while held in the plan.

Q. Q. Who is eligible for an RDSP?

A. A. To qualify to be an RDSP beneficiary, you must:

- Be eligible for the Disability Tax Credit

- Be a resident of Canada

- Be less than 60 years of age

- Have a valid Social Insurance Number

Q. Q. How do you qualify for the Disability Tax Credit (DTC)?

A. A person is DTC-eligible in a tax year if they have a severe and prolonged physical or mental impairment, and they or another person is entitled to a credit. To be entitled to the credit, Form T2201, Disability Tax Credit Certificate, must have been completed by a qualified physician or nurse practitioner and submitted to the Canada Revenue Agency for approval. For more information on the disability tax credit, see Persons with disabilities on the CRA website (www.cra-gc.ca)

FAQs—RDSP (continued)

Q. Can the holder pe a parent even if the beneficiary is over the age of majority?

A. Yes. If the parent has been legally appointed as a guardian of the beneficiary or is otherwise authorized to act for the beneficiary, that parent can be the holder whether the child is a minor or over the age of majority. A “qualifying family member” is allowed to establish an RDSP for a beneficiary who is not contractually competent. The definition of a qualifying family member is only a spouse, common-law partner or a parent. This is a temporary change and applies from July 2012 to the end of 2023. Even though this is temporary it is important to note that the account holder is able to remain as account holder beyond 2023. It is simply that any new RDSPs cannot be opened this way after 2023.

Q. Can an RRSP/RRIF or RPP of a deceased parent or grandparent be transferred to an RDSP?

A. Yes, tax-deferred transfers from RRSPs, RRIFs or RPPs are permitted to an RDSP as long as the beneficiary of the RDSP was financially dependent on the parent or grandparent. The amount transferred cannot exceed the beneficiary’s contribution limit. Contributions under these rules will be taxable to the RDSP beneficiary when withdrawn from the plan. In addition, contributions in these circumstances will not attract any Government grant or bond monies, so can be used as an immediate income stream for the RDSP beneficiary as long as no grants or bonds had been received in the 10 years preceding the withdrawal. Please note this rollover must be made directly from the RRSP/RRIF or RPP of the deceased and cannot be done from the estate of the deceased.

Q. What is the 10-year rule?

A. The 10-year rule is also known as the Assistance Holdback Amount (“AHA”). The purpose of the AHA is to ensure that RDSPs are used for long-term savings, and also to ensure that government funds contributed are not withdrawn and used as leverage for matching grants in future years. If a withdrawal from the RDSP is required during this AHA period, for example due to financial hardship, then a repayment of $3 of Government grants and bonds for every $1 withdrawn from the account would be required.

Q. Do I stop contributions after 10 years?

A. Some RDSP account holders are receiving letters from their bank implying that they should stop making contributions after 10 years has passed. The maximum grants that can be received from the government is $70,000 and it typically takes more than 10 years to reach this maximum. To prevent having to return any of the grants or bonds received in an RDSP, there needs to be a 10 year holding period that starts from the date of the last government contribution into the plan.

Q. What happens if the RDSP beneficiary is no longer DTC eligible?

A. Prior to Budget 2019 If an RDSP beneficiary is no longer eligible for the Disability Tax Credit (DTC), the RDSP account had to be closed by December 31 of the following year. Any grants and bonds in the account had to be repaid to the Government and are lost forever. Budget 2019 proposed to eliminate the requirement to close the RDSP account when someone loses the DTC. This will help retain grants and bonds in the account that under the previous rules needed to be repaid to the government. The RDSP account can remain open, but no new contributions can be made to the plan and it is not eligible for grant and bond or carry forward of grant and bond.

FAQs—Funding the Henson Trust

Q. How do you use life insurance to fund the Henson Trust?

A. The Henson Trust is generally created through your will, which means while you are living there is no Henson Trust. I am often asked “How do I save money today for the trust?”, insurance is the best way to guarantee money for the trust and can act like a savings account for Henson Trust. Let us look at a case study we have two parents John and Jane who have a daughter Julie who is living with them and receiving $896 a month in ODSP benefits. John and Jane are receiving $500 a month for room and board and they come to us and want to put aside some of these benefits for Julie’s future. We determine what amount they can save each month and they acquire a joint insurance policy on both of their lives. They will make small deposits each month and when they both pass away the death benefit, will be paid out directly to the Henson Trust.

Q. Is buying insurance better than just saving the money?

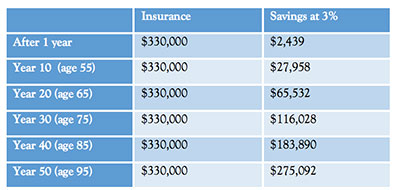

A. Let us compare the numbers by looking at our case study of John and Jane, who are 47 and 45. Of the $500 they are receiving for room and board they decide to save $200 a month and use insurance for the savings. This gives them a guaranteed $330,000 of life insurance that will pay out at the last death. The below shows the insurance versus saving that $200 a month at 3% with no taxes*

From day one they have $330,000 of coverage in place and that gives them security. Even if John and Jane live for 40 more years, until age 97 and 95 they will have only $183,890 in savings. Overall, the insurance strategy gives you a higher payout to the Henson Trust along with providing peace of mind for John and Jane.

Q. Why does using insurance to fund the Henson Trust make sense?

A. Using the insurance to fund the Henson Trust

- Gives you a guarantee and that gives you peace of mind

- The insurance provides more bang for your bucket then savings

- Insurance pays out in 31 days, without taxes or hassle

- It provides immediate future funds and no complication for trustees

Q. What are the draw backs?

A. Permanent insurance is a commitment and you need to ensure you are selecting the right plan and with a payment that

fits your budget. That is why we work one on one with everyone to design their Bright Futures Plan.

FAQs—Henson Trust (continued)

Q. What is the minimum/maximum amount of money that can be put into a Henson Trust and how much money can a person receive out of the trust each year?

A. Technically, there is no minimum amount that can be put into a Henson Trust. However it may not be practical to create a Henson Trust for smaller amounts. There is no maximum dollar amount. A person can receive up to $10,000 in a 12 month period from the trust and it can be used for any purpose. In addition, unlimited amounts can be received from the trust if the money is used for disability related expenses as defined by the ODSP regulations.

FAQs—ODSP

Q. I just received an inheritance of $300,000…can I set up a Henson Trust to shelter it from ODSP or will I lose my benefits?

A. Unfortunately, a Henson Trust cannot be created by the person receiving the inheritance…it must be created by the person leaving the money to you. However, there are other ways of sheltering the inheritance: Segregated Funds, RDSP’s and a variety of other tools.

Q. How much money can I have and still get ODSP?

A. The ODSP liquid asset limit for a single person is $40,000 and $50,000 for a couple. Liquid assets are things like money in the bank, stocks, bonds, mutual funds, GIC’s, coin collections, stamp collections, most RRSP’s, TFSA’s or anything else that is cash or easily converted into cash.

Q. I received the CERB payment. Do I have to report it to the ODSP and what happens if I do report it?

A. The Government is considering the CERB payments to be employment replacement income for those who are receiving ODSP benefits. This means that the first $200 will not impact the ODSP but 50% of the excess will be deducted from the monthly benefit. If monthly benefit is reduced to $0.00 because of the CERB payment, people will NOT lose their drug and dental benefits.

Q. I charge room and board of $500 per month to my disabled adult son. Do I include this as income on my personal tax

return?

A. Rent or room and board payments that are charged to a family member at below market rates are considered to be an expense sharing arrangement and do not need to be added to your income tax returns.

Q. I am a parent of an adult with disabilities and I receive child support payments from my ex-spouse. Will these payments be deducted from my child’s ODSP benefits?

A. Since January 2017, child support payments are no longer considered to be income to the disabled adult ODSP recipient. Prior to that time, slightly different rules were in place and you should contact Bright Futures Ability Network for details if that time frame applies to you.

Q. I am spending quite a bit of money on taxi rides to medical appointments. Will ODSP help?

A. If your actual medical transportation costs exceed $15 in a month, the excess may be paid by the ODSP. Under the Mandatory Special Necessities Benefit, you may be reimbursed for actual transportation expenses incurred in the form of public transit, private car or Taxi. Parking and appropriate meals, within limits, can also be reimbursed.

How we can help support you

Whether it’s a full financial and estate plan for your family or simply a plan to provide for your son or daughter with a disability, the Bright Futures Ability Network can guide you through the process of putting all the pieces of your planning puzzle together with expert advice and insights.

You can achieve a Bright Future for your family by allowing the Network members to provide support and guidance with your Wills and Henson Trusts, Life Insurance, Registered Disability Savings Plans (RDSP’s), Investment programs, Retirement planning, Estate planning Tax planning and Tax Returns, Disability Tax Credit Applications, ODSP planning and qualification, Trustee Support Services and much more.

We can offer a complete life insurance review with Erin Blair or an RDSP and Financial Plan review with Derrick Lee-Shanok or we can connect you with the PooranLaw Whole Life Planning Centre for integrated will, trust, estate and tax planning services.

Our team is still working remotely and available to speak with you. If you would like to have the peace of mind that a Bright Futures Plan can provide, feel free to reach out to us by email (info@brightfuturesplan.ca) or Book a Call

Recent Comments