Funding the Henson Trust

If you have gone through the time, put in the effort and made the financial investment to set up a Henson Trust in your wills, you want to make sure that it can be used to benefit your loved ones. That means you need to have money available for the Henson Trust. This money in the Henson Trust is used to provide the quality of life for your loved one. The majority of times, the Henson trust is not created until the parents or caregivers have passed away, it is formed from the wills. That means you cannot today go to the bank and set up a bank account for the Henson Trust, but we always get asked the same great question; how do I put away money today for my loved one. How can I save for the Henson Trust

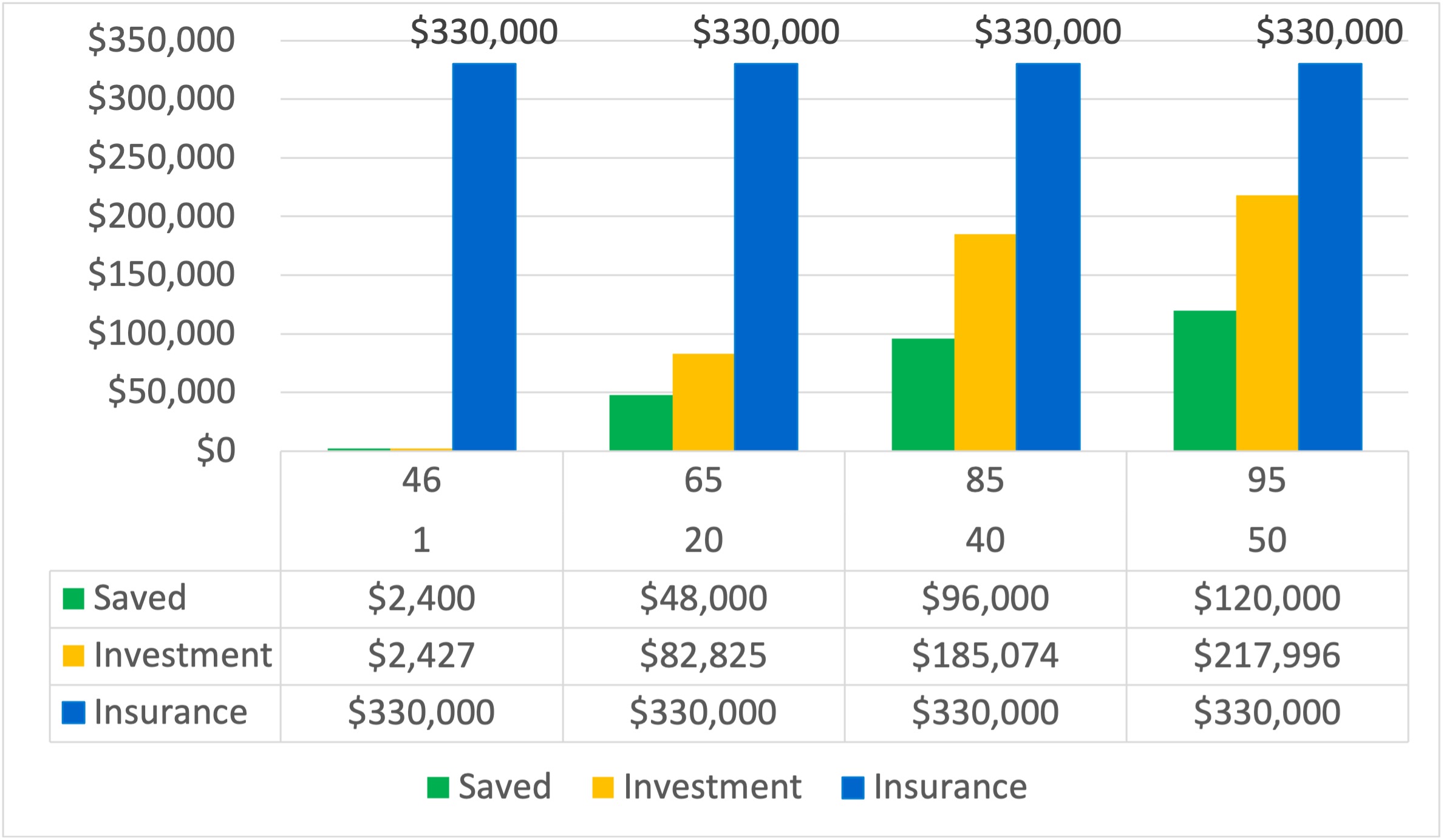

The Burks wonder if option 2 using the Bright Futures insurance plan will provide more for Julie’s future. Let’s compare the two options below on this graph. We show the Burks how much money they will save (green), how much their investment growing at a safe 3% a year (yellow) will be worth and the Bright Futures option (blue).

The advantages of the Bright Futures Saving Plan

- From the day the first $200 is saved, $330,000 is guaranteed.

- Even at age 95 (50 years after starting) the Bright Futures saving plan has more money for Julie then the savings alone.

- The Bright Futures Savings plan gives the Burks a guaranteed amount of money, that gives them peace of mind and a guaranteed number to plan for Julie with.

- The insurance money pays out tax-free.

- It is paid directly the Henson Trust within 31 days for Julie’s immediate usage.

- This results in reduced work for the trustee and a significantly shorter wait time for Julie to have money available for her.

How Does It All Work

- John and Jane set up their plan using Bright Futures insurance policy. They pay $200 a month and never have to think of the savings plan again. The price will never increase, and from day one they have $330,000 for the Henson Trust

- They name the Henson Trust as the beneficiary of the policy. When they pass away, the insurance company pays a cheque to the Henson trust within 31 days, and funds are available for their daughter Julie.

- The pool of money in the Henson trust can and should be invested to continue to grow. They contact Derrick Lee-Shanock the investment advisor on our team to manage this for the trustees.

- The trustee access money as they require it to provide for their Julie.

- When Julie passes away, there is a final beneficiary of the Henson trust the parents set up. They will receive anything additional in the Henson trust at that time.